New Construction Loans for Investors Without the Hassle

Empowering Builders by Building Strong, Reliable Relationships

New Construction Loans When You’re Ready To Go Vertical

We don’t hold you back. Our new construction loans are structured with fewer restrictions so investors can scale with confidence. When you’re ready to move forward with your next build, we’ll establish your maximum exposure and work efficiently to get you to closing as quickly as possible.

Once your first deal is completed, the process becomes seamless. When you’re ready to leverage your equity and fund your next project, simply submit your application, budget, and plan set, and we’ll move you through a fast, streamlined path to closing.

New Construction

Whether your strategy is build-to-rent or build-to-sell, we specialize in vertical construction financing for infill, shovel-ready, fully entitled land supporting both single builds and larger developments. Our investor-focused new construction loans are designed to deliver the flexibility, speed, and reliability needed to bring your projects to life.

Program Highlights

Up to 90% LTC, 70% LTARV

Loans from $100K to $5M

19- and 24- month loan term options

Interest-only new construction loans, paying only on drawn funds

Fast draw process, funds in as little as four days

1 - 4 Units

Rates as low as 9.45%

Cashout Refinance Option Available

Use fix & flip experience to qualify for new construction financing

Build2Rent

Two-close new construction loan program (one for build, one for the rental) that tackles the build-to-rent strategy.

Program Highlights

Single property and portfolio loan options

Fast, simple closings on both the construction loan and rental loan

19 & 24-month term options for the construction

Choose a fixed or adjustable rate mortgage on the rental loan

Flexible terms available: fixed rate, interest-only, ARM

Discounted fees on a refinance to rental loan

BridgePlus

Free up working capital with a bridge loan for new construction financing on completed new home inventory.

Program Highlights

Fast closing

Exterior-only valuations

Up to 80% LTV purchase / 75% LTV refinance

Non-recourse available

13, 19 & 24-month term options

Single loans and portfolio blanket loans

New Construction Loans With No Limits

As experienced new construction lenders, we work with builders of all types, and we’ve seen just about every kind of residential construction project. That means we’re comfortable with a wide variety of projects and strategies. It also means we know how to provide financing across a broad spectrum of construction projects without holding you back.

CUSTOMER EXPERIENCE

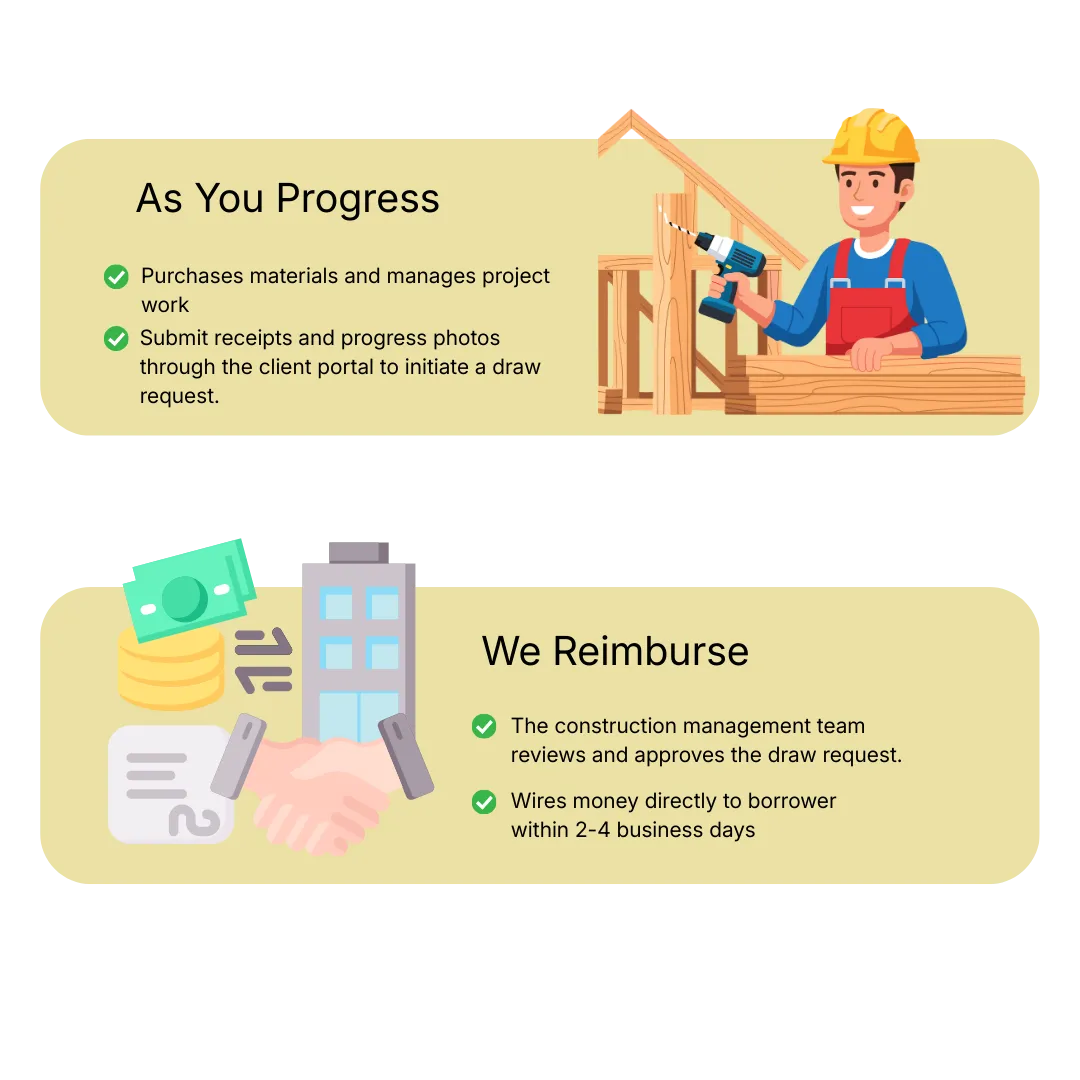

Draw Construction Funds in Four Days? Boost Your Speed To Build.

Securing funding quickly is essential to the success of any new construction project, whether you’re building a single-family home or launching a larger development. Our streamlined draw process is designed for speed, delivering funds to your account within four days so you can move forward with confidence and execute your strategy without delay.

Adkins & Williams Advisor vs. The Bank: The Tale of the (Red) Tape in New Construction

If you’ve ever pursued new construction financing through a traditional bank, you’re familiar with the delays caused by extensive paperwork, verifications, and approvals. We’re not saying banks do it wrong we simply take a more streamlined, investor-focused approach.

New Construction Loan FAQs

A new construction loan can cover both the cost of acquiring the lot and the vertical construction of the project. Adkins & Williams Advisors provides financing for ground-up new builds and tear-down/rebuild projects. Horizontal construction is not included, meaning the land must be properly zoned and have municipal utilities available and ready for connection to qualify.

Construction financing is best suited for investors with experience in ground-up projects, whether as a property owner, general contractor, or through fix-and-flip experience. Our team works closely with clients to review their background and determine eligibility. By completing the borrower underwriting process upfront, we’re able to streamline approvals and move qualified construction loans to closing more efficiently.

How do you get preapproved for a construction loan?

Preapproval for a new construction loan can begin with or without a project that is ready to break ground. First, borrowers must demonstrate relevant experience with new construction either as a property owner, general contractor, or through prior fix-and-flip projects.

Second, borrowers must show sufficient liquid assets so a maximum credit exposure limit can be established. This limit is valid for up to six months and may be applied to a single project or multiple projects.

Finally, borrowers will consent to a soft credit inquiry during the preapproval stage. A hard credit pull will only be required once a loan is formally submitted.

How much down for an investor to get a construction loan?

For highly experienced builders, financing may cover up to 85% of the total blended project costs, including up to 100% of construction costs and up to 60% of lot acquisition costs. Borrowers with less construction experience should expect to contribute a larger upfront investment at the start of the loan.

What is a Construction-to-Permanent Loan?

A construction-to-permanent loan is designed for build-to-rent projects. The initial construction loan finances the build, and once the property is completed and a tenant is in place, the borrower refinances into a DSCR loan to hold the property as a long-term rental. This structure allows investors to move seamlessly from construction to stabilization, with a streamlined transition into permanent rental financing and no required seasoning period between loans

What level of documentation or project plan (e.g., approved permits, contractor bids, timelines) does Lima One require before approving a new construction loan?

To move forward with a new construction loan, borrowers must submit building plans, a detailed line-item construction budget, and supporting project documentation as part of the property application. Our in-house team carefully reviews the budget to ensure it is realistic, complete, and aligned with the scope of the project. As part of the underwriting process, a review of the general contractor is also conducted to confirm qualifications and project readiness.

What are the loan term lengths for a new construction loan?

New construction loans typically offer a standard term of 13 months, with extended 19-month terms available for qualifying projects.

Are foreign nationals eligible for new construction loans?

Yes, foreign nationals may qualify for ground-up construction loans, even without an established U.S. credit score. Eligibility is evaluated based on borrower qualifications and project details, and our team can guide foreign nationals and permanent resident aliens through the underwriting requirements.

For additional questions about ground-up construction loans and financing options, please refer to our detailed FAQ section for more information.

Still Have Questions About New Construction Loans?

Need More Details? Ready To Go?

We’re here to help when you’re ready. Reach out today about new construction financing.

Copyrights 202X | Your Brand™ | Terms & Conditions